Digital applications have revolutionised the mobile phone sector, producing new business models. Ashley Potter finds out whether the same could be about to happen to the car industry

Digital applications have revolutionised the mobile phone sector, producing new business models. Ashley Potter finds out whether the same could be about to happen to the car industry

The car industry is currently mulling over the biggest transformation in its history since Henry Ford set up shop in Dearborn, Michigan. Before Ford, the automobile was an expensive plaything for the rich that had little effect on the prevalent form of transportation – horse-drawn vehicles. Ford’s introduction of the mass production assembly line and product standardisation (“any colour so long as it’s black”) brought his Model T car within the range of the masses, fundamentally disrupting the transport market and sending millions of horses to the knacker’s yard.

Today’s disruptive force is already in most people’s offices, homes and pocket: digital technology. It put a man on the moon in the sixties and sacked the CD in the noughties. But just as digital technology has disrupted business models in the newspaper and music sectors, so the car industry is contemplating just where digital technology will send it spinning.

Executives and strategists at the head offices of automobile giants such as Volkswagen and GM are trying to figure out how they will navigate their way through the digital wormhole. Will GM, Ford and Toyota step into a world full of new possibilities or onto a planet where they no longer exist?

Ola Henfridsson, Professor of Information Systems and Management at Warwick Business School, has spent the last eight years consulting and researching digital innovation at GM, Volvo and Saab and, while he admits he doesn’t know what they will find either, he is sure the open platform car is coming.

“It will happen,” says Henfridsson (who looks more like a rock star than the traditional academic). “Why wouldn’t it?”

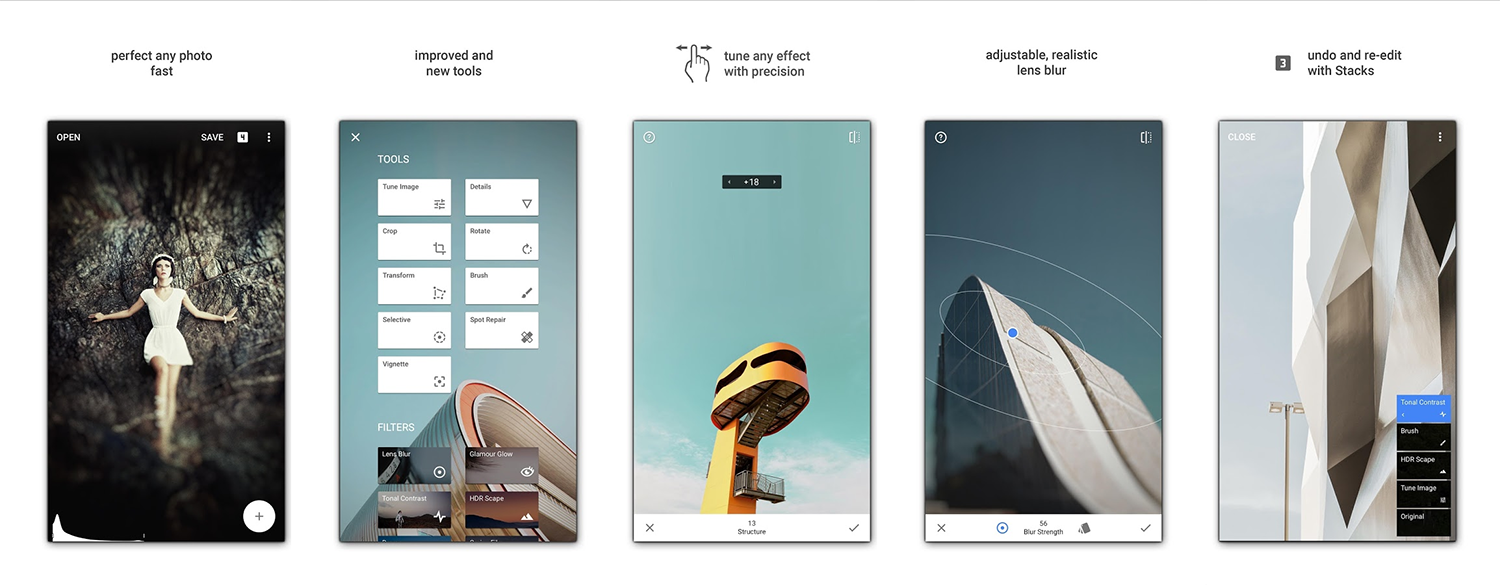

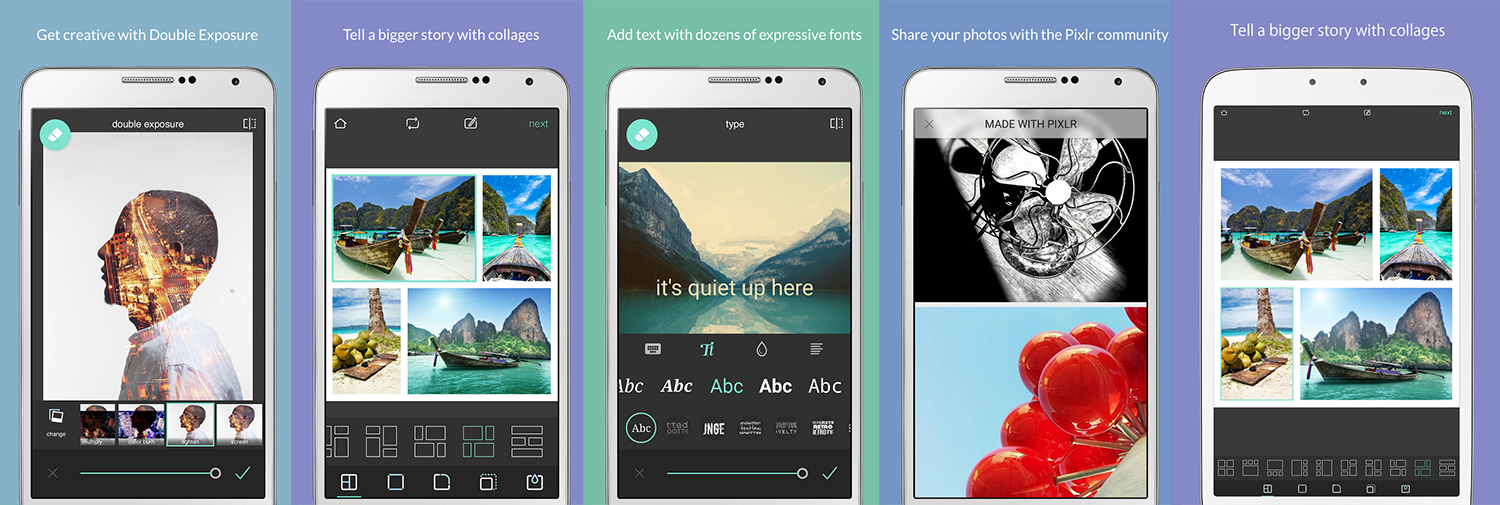

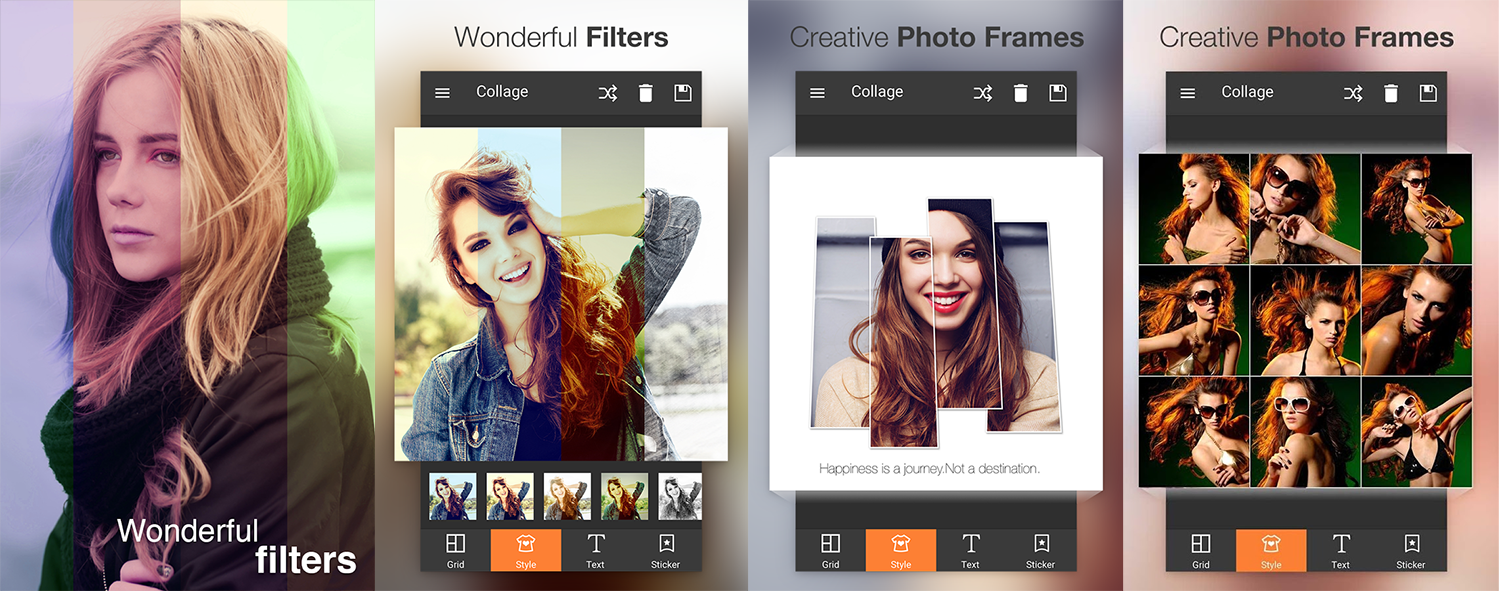

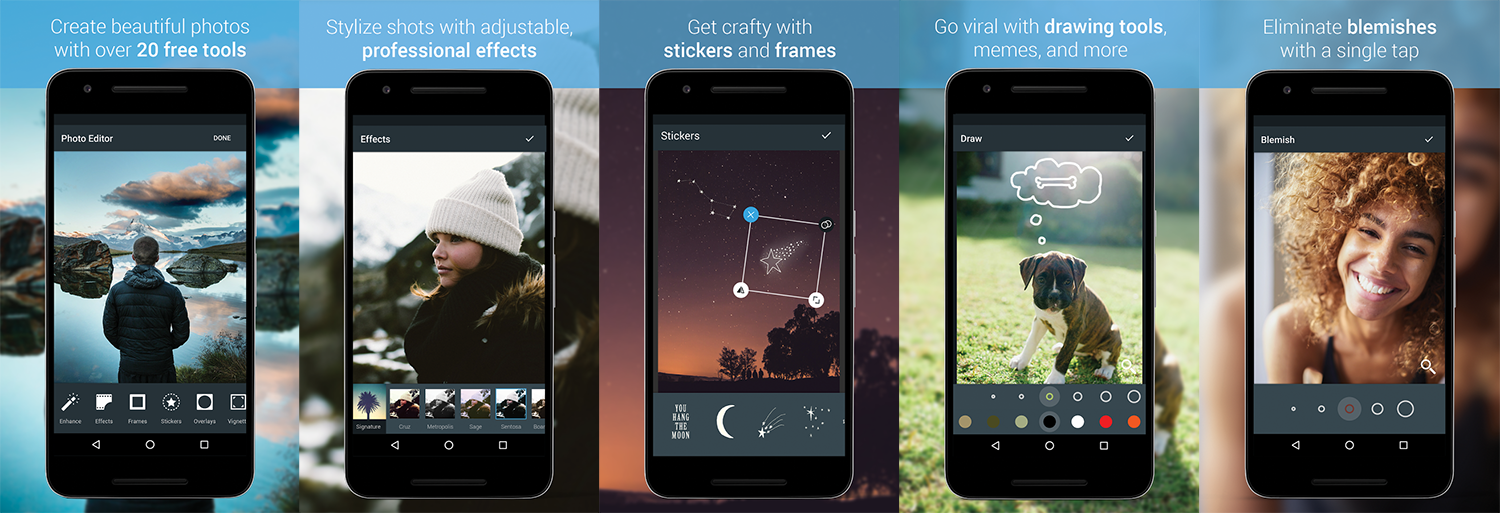

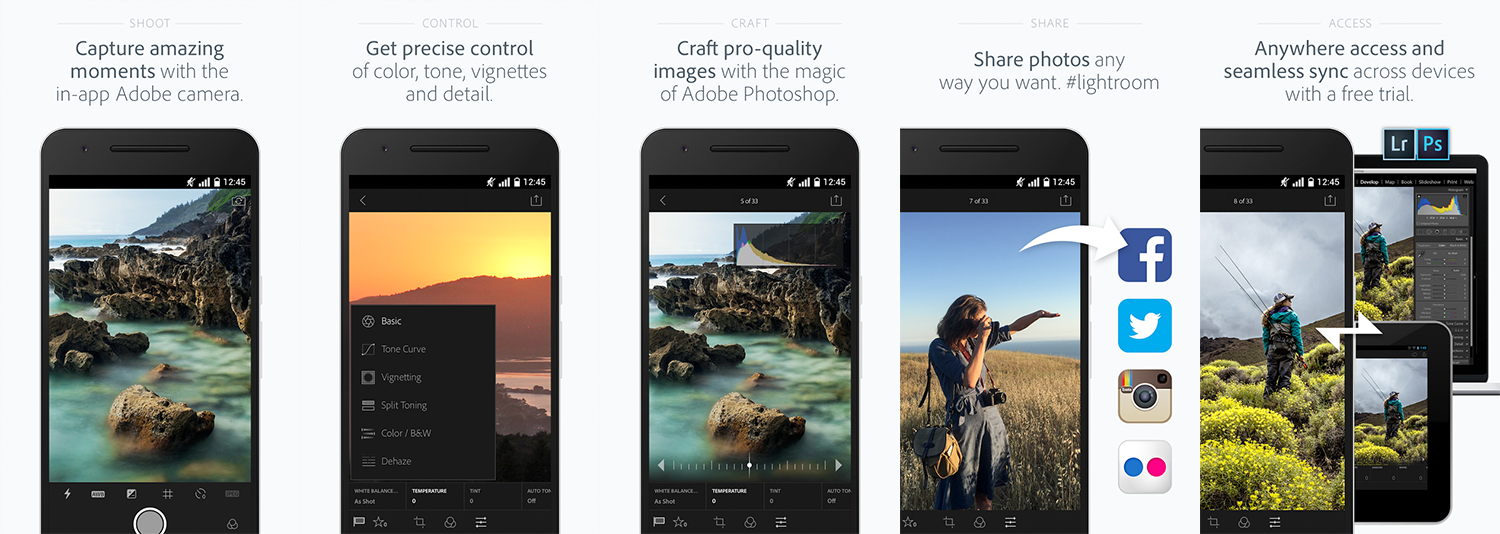

Just as the smartphone has become a platform where users can download any apps they want and connect to the cloud, so the car could become a giant mobile version.

“If you can develop an Android community with so many useful apps, think what could happen with cars,” says Henfridsson.

“Much of the value of today’s car and the cost of developing it is related to the digital technology. When it comes to lowering fuel consumption or new safety features it is very much about the digital infrastructure, which requires a totally new skill set for the people developing the car.

“It used to be that competition within the car industry was locked into the boundaries of the car manufacturers, but suddenly there are non-automotive companies taking parts of the markets. Microsoft are heading into it along with Google and others. Why is it that Google has 10 driverless cars on the streets of California? Because they are imagining a future where a car communicates with its environment, where what will be important in a car’s functionality is not something that GM or Volkswagen can deliver.

“Suddenly, you can see that the car industry needs to engage with the ‘crowd’, where anybody with £300 and a good idea can become an entrepreneur.”

In the world of open platform cars a kid in a bedroom could become the next giant car company. Just as Mark Zuckerberg has taken over the internet with Facebook, so the next major car development could come from a dormitory at a US university rather than the R&D department of BMW. And that is what is worrying the manufacturers; opening up their cars to third-party developers could see them lose control of their own products.

Car executives are nervous, but they are now dipping their toes in the digital waters. Apps are in cars now, and in January Ford launched its open mobile app developer programmer for iOS and Android. But it is limiting developers to its car’s entertainment systems and developers will have to submit an app to Ford for review by its engineers. Once it’s been approved, developers get a distribution license so the app can be submitted to the relevant app stores.

Car executives are nervous, but they are now dipping their toes in the digital waters. Apps are in cars now, and in January Ford launched its open mobile app developer programmer for iOS and Android. But it is limiting developers to its car’s entertainment systems and developers will have to submit an app to Ford for review by its engineers. Once it’s been approved, developers get a distribution license so the app can be submitted to the relevant app stores.

More interesting is Google’s tie-up with Audi, GM, Honda and Hyundai in the Open Automotive Alliance (OAA) to develop a common platform for Android apps on their cars. It was something that Helen Falkås was working on at Saab until it filed for bankruptcy in 2011.

Falkås, who is now Senior Project Manager at Nordiska Interaktionsbyrån, a leading interaction design agency in the Scandinavian car industry, says: “We were talking about a two-sided market where you have to give the developers the possibility to have some business benefits with a large customer base and the customers are looking for good content, rather than the proprietary market that the car industry has used. We were looking to lower the threshold of entry for developers to open up a standard Application Programming Interface (API) so data could be accessed to create the open space.

“There were several research projects we were discussing with Google, as you need somebody of that size to push the industry into this open space, but they said they will go into the car industry once they have done tablets and TV.

“Now they have brought in several car manufacturers as they always said they were looking for more volume. It will be very interesting to see whether they can standardise an open platform across several car manufacturers, because there is a lot of traditional thinking in the automotive industry. We are seeing semi-open platforms for infotainment, but we were looking at the engine management system and other digital systems in the car. After all, there are 500 signals which are pretty similar in all cars. They have different protocols and different systems of language, but if it was standardised you would have greater potential to create new apps. But this will take time. It took 15 years to introduce ABS brakes in large scale, so that gives you an idea of how slowly the car industry moves.”

A project Falkås worked on with Saab and the Swedish road authority gives some idea of the potential value of connecting all makes of cars across a digital platform.

“Icy roads are a big issue in Sweden, so we developed an app where you would know exactly where and when a road was slippery and even in what direction cars were sliding,” says Falkås. “That information is available in cars today. These cars would relay instantly to the authority which road was slippery and how slippery so they could pinpoint their efforts, because it is very expensive to keep roads safe in the winter and salt is bad for the environment.”

That was with just 50 Saabs, but imagine if all cars were relaying this information to the Highways Agency and to drivers as well in real time, it would surely help make roads safer. Falkås’ only problem was the business model as it produced cost savings for the road authority but little value for the car manufacturer.

But Henfridsson argues that is one of the points of opening up access to cars’ data – third-party developers will work out business models and apps we can’t even dream of, as happened with smartphones.

These developers will be focused on the drivers and the user experience more so than car manufacturers would be, after all they have been fiddling around with suspensions

for decades.

“In the past if you wanted to be successful in the car industry you needed a huge amount of investment,” says Henfridsson. “The car industry has been so focused on scale, that it is only a few companies who own those resources who have been controlling what has been going into the car. Now, we will see the birth of customer-driven DIY developments in the car. An app store for cars, that is what is coming, anyone can design apps for cars.

“Instead of one navigation system you might have 10, or some navigation aid nobody has thought about before and you might be able to sell advertising through this app. Plus opening up to the crowd addresses some of the customisation issues car manufacturers make for local markets. Traditionally they want to minimise them because it drives up cost, but this turns it around, as a small app developer in each country can do those adaptations and it won’t cost the car manufacturer a penny.

“Also, normally in the car industry you need a four or six-year cycle in car development to get your investment back, but this will change. Software can be reproduced at a minimal cost, at the point when you share with the Android community.

“GM asked a company to develop a new navigation system. It took them 18 months – it’s an expensive process and would then be expensive for the customers. The Android community contains up to 20 navigation systems at the moment, it can very easily be adapted for a bigger screen for the car. So, now, your development costs can be so much lower and quicker.”

Other industries would love to get their hands on car data, one obvious one being insurance companies.

“Very soon we will have insurance companies setting up deals with customers to gain information on how they drive,” says Henfridsson. “You would be able to have lower fees for those that drive carefully, but at the point you speed you would lose that deal, and it would be personalised to each individual.

“This will cut across industries, because digitalising the car means it becomes another sensor within a huge network. Google might not want to sell cars, but it definitely sees them as another source of information that they can use to become even better in digitising the world. How is the traffic situation in Los Angeles? Search Google cars and find out.

“Also, in the Android world developments are being pushed out and customers are testing it for you. The car industry is totally different where it has to be perfect for the customer before it is on the market, but releasing a new patch for the software doesn’t cost anything.”

It could be the end of all those costly recalls to adjust the steering system or throttle, just send out a system update and it would be done – though repairs done digitally could have a serious impact on car dealerships, a relationship that car manufacturers would be loath to hurt. And talk of app developers being allowed into the engine, suspension, and brakes of a car must send many car executives into convulsions. Who is liable if something goes wrong if there is a crash? Is the insurance company going to turn to the app developer or the car manufacturer?

Falkås reveals how Saab planned to open the engine management system to developers in stages.

“You could select certain sensors and data to publish as ‘read only’,” says Falkås. “The next step for selected third-party companies with whom the car manufacturer is in partnership is to give them the ability to write into the system, as you would still have liability. There would then be possibilities to have a bundle for something like additional horsepower; it would be a gradual process.”

Liability is one issue that has to be resolved, but Henfridsson is sure it will be and believes whoever moves first to totally open up their car will have a big advantage.

The biggest worry for the car manufacturers is that if they don’t do it somebody else will, somebody of the scale of Google or Apple. They could make a standard car and then send it out as an open platform vehicle, transforming the industry and potentially killing off some of the big manufacturers.

“An app that can tune your engine could have been done 10 years ago,” says Henfridsson. “At the point GM or Audi allows third-party developers to design apps to tune their engine there would be hundreds of them. They may not allow access to the braking system, engine, or power train immediately, but it will soon come. There is a middle ground, where you can have 60 or 70 trusted vendors. But why not have other people innovate on your platform? That is what you want to be, a platform owner like Facebook. It is very old fashioned to sell a whole product these days.

“This is coming, car manufacturers know it and they can’t stop it. We will see a totally new car industry when digital takes over.

“It will change everything, there will be new brands that might be connected to Google rather than a car manufacturer. It is a do-or-die issue for the car industry.”

This article originally appeared in the Warwick Business School (WBS) magazine, Core.

You can find out more about WBS by clicking here. You can also find them on Twitter, by clicking here: @WarwickBSchool

More from the 7dayshop blog – click below

Red Arrows: stunning winter photos